When Is An Appraisal Ordered in the Loan Process?

Published: November 2024

So, when is an appraisal ordered in the loan process? It happens after your lender gives the green light on your loan application, which typically takes place 15-30 days into the loan process. This step ensures the home’s value matches up with the loan amount, giving everyone (including you!) peace of mind.

Think of the appraisal as a safety net, making sure your investment is solid and setting you up for success. Curious about the details? Let’s break it all down!

Understanding the Appraisal in the Home Loan Process

The Role of a Home Appraisal

An appraisal isn’t just a step in the loan process—it’s the foundation for making sound financial decisions. It ensures the home’s value aligns with the loan amount, protecting buyers from overpaying and lenders from unnecessary risk.

Want to dive deeper? Check out our post on The Importance of an Appraisal in Real Estate Transactions.

What Does An Appraiser Look For?

When appraisers value a home, they focus on key factors that influence its market value. One major element is the condition of the home—this includes its structural integrity, age, and any recent updates or renovations.

They also consider the property’s size, location, and unique features, like a finished basement or upgraded kitchen. Surrounding market conditions and comparable sales in the area (called “comps”) are also weighed in. Together, these factors paint a clear picture of the home’s true worth.

Category |

Details |

|---|---|

Condition of the Home |

Roof, foundation, windows, and overall upkeep. |

Structural Integrity |

Signs of damage, stability, and construction quality. |

Home Updates |

Renovations, modern appliances, and upgrades like new flooring or fixtures. |

Size and Layout |

Square footage, number of rooms, and overall functionality of the space. |

Location |

Neighborhood, school districts, and proximity to amenities. |

Market Comparables |

Sale prices of similar homes in the area. |

Why Lenders Require an Appraisal

Lenders rely on appraisals to ensure the loan amount accurately reflects the property’s market value.

This step protects the lender from over-lending and safeguards the buyer from overpaying for a home.

Think of it as a reality check: the appraisal confirms that the property is worth the investment, reducing financial risks for everyone involved.

Without it, lenders could face significant losses, and buyers might unknowingly take on a loan for more than the home is worth.

Key Players in the Appraisal Process

Several key players contribute to a successful appraisal process, each with an important role:

- The Mortgage Lender: The mortgage lender orders the appraisal to determine the property’s value and confirm it aligns with the loan amount.

- The Appraiser: A certified professional who conducts the evaluation, analyzing the home’s condition, features, and market trends.

- The Borrower: While the borrower doesn’t directly manage the appraisal, they’re responsible for covering the cost as part of the loan process.

- Appraisal Management Companies (AMCs): These act as intermediaries between lenders and appraisers, ensuring compliance with regulations and streamlining the process.

Triangle Appraisal Group proudly works with over 200 AMCs, demonstrating our commitment to timely, accurate, and reliable appraisals.

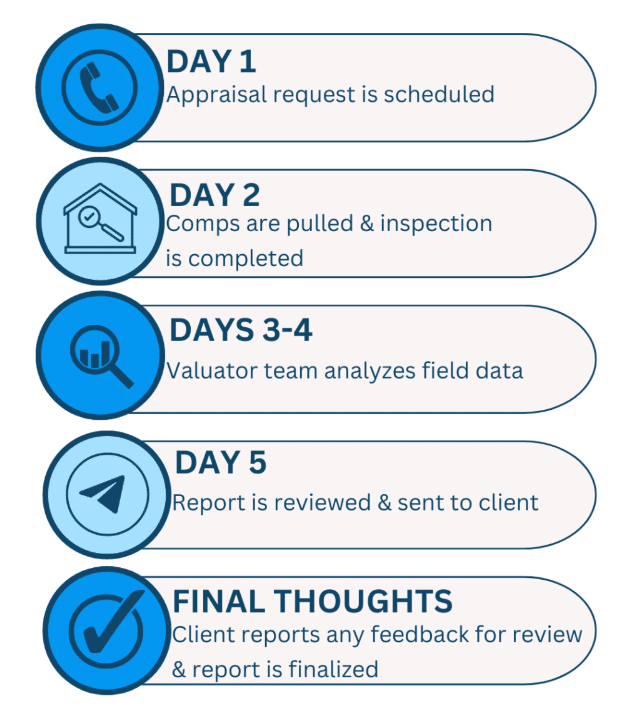

Our 5-day Process

Timing of the Appraisal Order

The timing of an appraisal is crucial to keeping the loan process on track. Typically, the mortgage lender orders the appraisal once the initial loan application has been reviewed and approved.

This usually happens in the middle phase of the process, around days 15 to 30 of a standard 30- to 40-day timeline.

Working with a trusted appraisal company like TAG can help avoid delays. We pride ourselves on delivering accurate appraisals quickly—often 3-5 days after our inspection!

Our team is also able to complete rush orders (same day/next day service) when needed!

The Home Appraisal Timeline Explained

After the Appraisal: What Comes Next?

Once the appraisal is complete, the lender reviews the report to ensure everything aligns with the loan

application. But what happens next?

- Understanding the Appraisal Report: The report outlines the property’s market value, condition, and any relevant comparables. Buyers typically receive a copy after the lender’s review.

- Steps Following the Appraisal Outcome: If the appraisal meets or exceeds the agreed price, it’s smooth sailing to the next stage of loan approval.

- Addressing Issues: If the appraisal is lower than expected, buyers and sellers may need to renegotiate the price, or lenders may adjust loan terms.

Addressing Appraisal Issues

Sometimes, appraisals don’t come back as expected. Here’s what to do if you encounter challenges:

- What If the Appraisal Is Lower Than Expected?

A low appraisal can be a roadblock, but it’s not the end of the road. Buyers and sellers can renegotiate the purchase price, or the buyer may bring extra funds to close the gap. - Negotiating After an Unfavorable Appraisal

Sellers might agree to reduce the price, or buyers could request repairs or credits to offset the difference. Clear communication is key! - Appraisal Disputes and Revisions

If you believe the appraisal missed critical details, your lender may request a review or reconsideration. This process allows appraisers to review additional information or address discrepancies.

For more insight into what can impact a home appraisal, check out our blog: What Hurts a Home Appraisal?.

The Bottom Line on Home Appraisals in the Loan Process

Home appraisals are a vital step in the loan process, ensuring transparency, accuracy, and fairness for all parties involved. From confirming the property’s value to resolving appraisal issues, every step is designed to protect your investment.

At TAG, we understand how important timeliness and accuracy are during this critical phase. Our experienced team works efficiently to deliver fast, reliable appraisals that keep the loan process moving smoothly.

So, when is an appraisal ordered in the loan process? It’s the moment where precision and professionalism come together to help you take one step closer to achieving your homeownership goals- TAG us in!

FAQs

An appraisal is typically ordered once a buyer and seller have signed a purchase agreement. At this stage, the lender initiates the appraisal to confirm the property’s value matches the agreed-upon purchase price. For refinances, the lender will order the appraisal shortly after you’ve submitted your loan application.

Yes, the appraisal is generally ordered before the underwriting process is fully completed. Lenders need the appraisal report to assess the property’s value and ensure it aligns with the requested loan amount. The underwriting team uses this information to determine the final loan approval.

Not necessarily. An appraisal is one piece of the puzzle- Your loan approval also depends on other factors like your credit, income, and debt-to-income ratio. If the appraisal supports the property’s value and your financials check out, your loan is more likely to be approved.

The appraisal is usually completed 2-4 weeks before closing. Timing can vary depending on how quickly the appraiser can inspect the property, complete their report, and submit it to the lender. At TAG, we aim to deliver appraisal reports within 3-5 days of the inspection to help keep things moving smoothly.

Once the lender orders the appraisal, it typically takes 1-2 weeks for the process to be completed. However, at TAG, we pride ourselves on delivering timely results. Most clients can expect their appraisal report back within just a few days of the property inspection.