What Is A Property Tax Millage Rate?

Published: November 2024

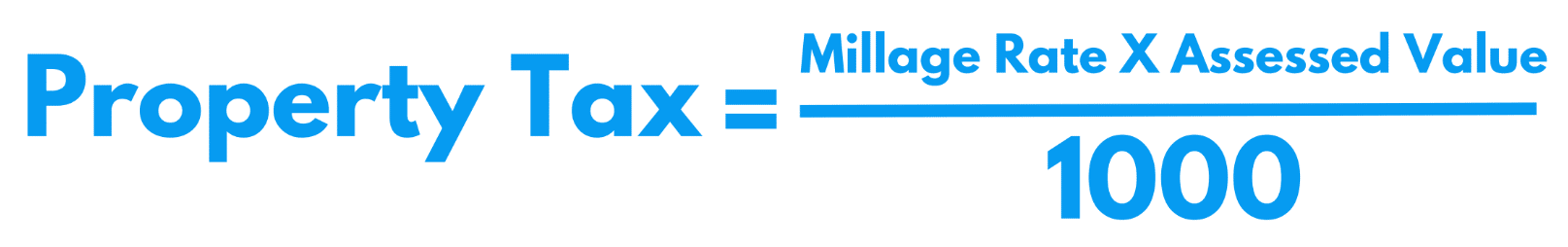

A property tax millage rate is the amount used to calculate property taxes, expressed as dollars per $1,000 of a property’s assessed value. Local governments determine this rate to fund essential services like schools, roads, and public safety.

Understanding how the millage rate works can help you estimate your property taxes and plan your budget. In this blog, we’ll explain what a millage rate is, how it’s calculated, and why it matters for homeowners.

What is A Millage Rate?

The term millage rate (or mill rate) refers to the tax rate applied to your property’s assessed value.

A “mill” is simply one-thousandth of a dollar, or $1 for every $1,000 of assessed value. For example, a millage rate of 10 mills means you pay $10 in taxes for every $1,000 of your property’s assessed value.

Local governments use the millage rate to calculate how much revenue they need to fund services like schools, roads, and public safety.

This means the rate can vary depending on where you live and the specific needs of your community.

Understanding the mill rate for property taxes is crucial because it directly impacts how much you owe annually.

How Does The Millage Rate Work?

The mill rate works by translating a property’s assessed value into the amount of tax you owe.

Local governments set the rate based on their budget needs, which fund essential services like schools, roads, and emergency services.

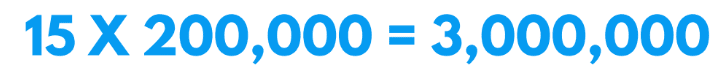

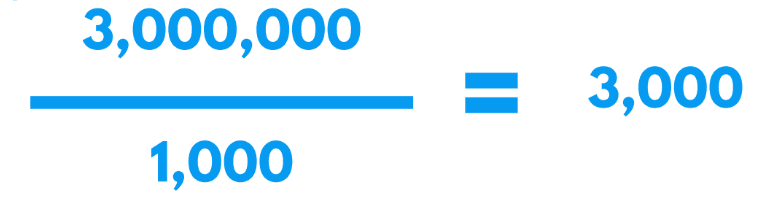

For example, if your property’s assessed value is $200,000 and the mill rate is 15 mills (equivalent to $15 per $1,000 of value), your property tax would be calculated as:

How To Calculate Property Tax From The Millage Rate

Calculating your property tax from the mill rate is straightforward if you follow these steps:

- 1. Find your property’s assessed value

This is the taxable value of your property, often determined by your local tax assessor. - 2. Obtain the millage rate for your area

This information is typically available on your property tax bill or through your local tax office. - 3. Multiply the millage rate by the assessed value:

- 4. Divide the result by 1000:

This means you would owe $3,000 in property taxes for the year. The mill rate for property taxes can vary widely, so it’s important to know your local rate to estimate your tax bill accurately.

Common Questions About Millage Rates

What is a mill in real estate?

A “mill” in real estate is one-thousandth of a dollar, or $1 for every $1,000 of a property’s assessed value. Millage rates use this unit to calculate property taxes.

How are millage rates determined?

Local governments set the millage rate based on their budget needs for services like schools, public safety, and infrastructure. These rates are approved through local government votes or, in some cases, by public referendums.

Why do millage rates differ by location?

Millage rates vary because different communities have unique budget needs. For example, a city with a large public school system may require a higher millage rate than a rural area with fewer services.

Can millage rates change over time?

Yes, they can. Changes in local government budgets, voter-approved measures, or shifts in property values may all lead to adjustments in the millage rate.

If you have additional questions about millage rates or how they affect your property taxes, feel free to contact our team for guidance.

Why Understanding Millage Rates Matters

Knowing your property tax millage rate is essential for understanding and planning your financial obligations as a homeowner. Since the mill rate for property taxes determines how much you owe, even small changes in the rate can have a significant impact on your tax bill.

For homeowners, understanding the millage rate can help with:

- Estimating property taxes: This ensures there are no surprises when your tax bill arrives.

- Budgeting for annual costs: Property taxes are a recurring expense, so it’s helpful to know what to expect.

- Property tax appeals: If you believe your property has been overvalued, a professional appraisal can support an appeal to lower your taxes.

At TAG, we specialize in providing accurate appraisals to ensure homeowners are paying fair taxes. Whether

you’re appealing an assessment or planning for future expenses, understanding your millage tax rate is a critical first step.

Why Millage Rates Matter to You

The property tax millage rate is a key factor in calculating how much you owe in property taxes.

By understanding what a millage rate is, how it works, and how to calculate your taxes, you can take control of your financial planning and avoid surprises.

If you’re unsure about your property’s assessed value or believe your tax bill is too high, the TAG team is here to help.

With our accurate and reliable appraisals, we can provide the support you need for property tax appeals or better financial clarity.

Contact us today to learn more about how we can assist you with all your appraisal needs!

FAQs

In North Carolina, property tax is calculated by multiplying your property’s assessed value by the local millage rate and then dividing by 1,000. The assessed value is determined by your county’s tax office, typically during periodic revaluations. Your tax bill reflects this calculation and funds local services like schools, roads, and public safety.

North Carolina residents 65 or older, or those who are totally and permanently disabled, may qualify for a homestead exclusion. This program reduces the taxable value of their property by $25,000 or 50%, whichever is greater. While it doesn’t eliminate taxes entirely, it can provide significant savings for eligible homeowners.

You can find your property’s tax value by visiting your county tax assessor’s website or reviewing your latest property tax bill. This value is based on your property’s assessed value, which reflects the market value during the most recent countywide revaluation. Contact your local tax office if you need assistance accessing this information.

To reduce property taxes in NC, you can appeal your assessed value if you believe it’s too high, often supported by a professional appraisal. Check if you qualify for tax relief programs, such as those for seniors, veterans, or disabled persons. Additionally, ensure your property records are accurate, as incorrect details could lead to higher taxes.