Full vs. Desktop Appraisals for Your

Property Tax Appeal

Published: September 2024

Navigating a property tax appeal can be a daunting task, especially when it comes to selecting the right appraisal to support your case. At Triangle Appraisal Group (TAG), we understand that the success of your appeal heavily depends on the accuracy and appropriateness of the appraisal method used.

Whether you opt for a full appraisal or a desktop appraisal, making an informed decision is crucial. In this guide, we’ll explore the differences between these two types of appraisals and help you determine which is best suited for your situation. Let’s delve into what each appraisal entails and guide you through the process with clarity and expertise.

Understanding Appraisals

Our team offers both full and desktop appraisals for tax appeals, each serving distinct purposes and providing different levels of detail. Understanding the nuances between these two can significantly influence your decision- making process during a property tax appeal.

Full Appraisal

A full appraisal is the most comprehensive type of appraisal, involving a thorough inspection of your property. Our licensed appraisers physically visit your property, assess its condition, take measurements, and note any improvements or features. This process ensures a detailed report that reflects the true value of your property, incorporating factors like market trends, property comparisons, and local insights.

Desktop Appraisal

A desktop appraisal, on the other hand, is conducted without a physical visit to the property. Instead, appraisers use online data, property listings, and other available records to evaluate the property’s value. This type of appraisal is quicker and less costly, but it relies heavily on the accuracy of the data used and provides a less personalized assessment.

To help you visualize the differences, here’s a comparative chart outlining the key aspects of full and desktop

appraisals

| Feature | Full Appraisal | Desktop Appraisal |

|---|---|---|

| Inspection | One site, detailed, and performed by a licensed appraiser | None, relies on public records and data supplied by the owner |

| Cost | Higher due to thorough, hands-on analysis | Lower, more economical |

| Time | Longer, due to detailed inspection (3-5 days) | Quicker turnaround (1-3 days) |

| Data Reliability | Direct assessment | Depends on external sources |

| Suitability | Complex cases, detailed needs | Straightforward cases, retroactive cases |

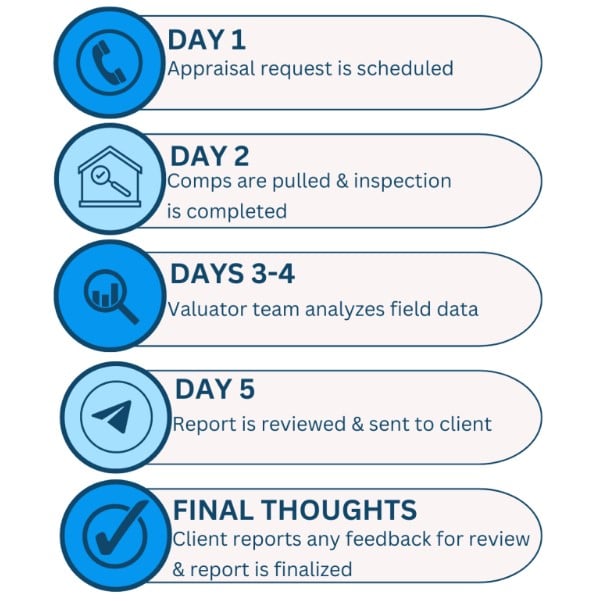

Our Full Appraisal Process

When to Consider a Full Appraisal

A full appraisal is often the best choice when dealing with complex property situations or when accuracy and detail are paramount. We recommend opting for a full appraisal under the following circumstances:

- Complex Properties: If your property has unique features, uncommon architecture, or customized additions, a full appraisal is necessary to capture the true value these elements add.

- Disputes Over Property Features or Records: When there are discrepancies between public records and actual property details, a full appraisal can provide the accurate measurements and thorough documentation needed to resolve these issues.

- Recent Significant Improvements: If you’ve recently undertaken major renovations or improvements that could substantially affect the property’s value, a full appraisal will take these into account, providing a current, realistic valuation.

Benefits of a Full Appraisal:

- Comprehensive Analysis: Includes a detailed examination of the property and its surroundings, ensuring every aspect of the property is evaluated.

- Accurate Measurements: Unlike some assessments that might rely on outdated or incorrect public records, our appraisers measure your property meticulously, ensuring every square foot is accounted for.

- Detailed Report: Our full appraisal reports are exhaustive and include a sketch of the home, photographs, and a narrative that explains the valuation process and results.

Choosing a full appraisal ensures a robust and defendable appraisal report that can be crucial in a contentious tax appeal, providing you with a strong foundation to challenge inaccurate tax assessments.

When to Opt for a Desktop Appraisal

A desktop appraisal is an efficient and cost-effective option suitable for specific scenarios. Our team suggests considering a desktop appraisal in the following situations:

- Straightforward Properties: If your property does not contain unusual features or extensive customizations and resembles other properties in the area, a desktop appraisal might suffice.

- Limited Budget: When cost is a significant concern, desktop appraisals offer a more affordable alternative to full appraisals while still providing a reliable estimate of property value.

- Quicker Turnaround Required: If you are pressed for time, such as nearing a deadline for a tax appeal, the faster processing time of a desktop appraisal can be a critical advantage.

- Retroactive Cases: For situations requiring a historical valuation of the property, such as settling estate issues or retroactive financial analysis, a desktop appraisal can effectively utilize historical data and records to assess past property values without the need for a current physical inspection.

Advantages of Desktop Appraisals:

- Cost Efficiency: Less expensive than full appraisals because they require less time and resources.

- Speed: Typically completed quicker due to the absence of a physical site visit and reliance on digital data.

- Simplicity: Effective for properties that are well-documented and do not require the detailed scrutiny of a full appraisal.

While desktop appraisals provide a quicker and more economical alternative, they rely heavily on existing data, past MLS info, and information provided by the owner, which may not always be up-to-date or fully accurate. They are best used when you are confident in the comparability and simplicity of the property and its features.

Impact on Tax Appeals

The type of appraisal you choose can significantly influence the outcome of your property tax appeal. The TAG Team ensures that our clients understand how each appraisal method can impact their case:

- Credibility and Acceptance: Full appraisals are generally viewed as more credible due to their comprehensive nature and detailed analysis. They are often favored in formal appeals where the stakes are high and detailed documentation is scrutinized.

- Meeting Legal or Formal Requirements: Some jurisdictions or appeal boards require specific types of appraisals. A full appraisal usually meets the most stringent requirements due to its thorough approach.

- Potential for Successful Appeal: A full appraisal may offer a better chance of success in reducing your tax assessment, particularly if there are complex issues at play. Its detailed report provides a robust defense against over-assessments.

Conversely, desktop appraisals might be sufficient for straightforward cases or initial assessments where less

complexity is involved. They can still support an appeal effectively, especially when budget and time constraints

are critical factors.

Key Considerations:

- Understand the Scope: Knowing what each type of appraisal entails can help you align your choice with the expected rigor of the tax appeal process.

- Consult with Professionals: Engaging with experienced appraisers like ours at TAG can guide you towards the best choice based on the specifics of your property and the local tax appeal regulations.

Making an informed decision about which appraisal to use will not only affect the direct outcome of your tax

appeal but also ensure that you are adequately prepared to navigate the complexities of the appeals process

Case Studies

To illustrate the practical impact of choosing the right type of appraisal, here are some hypothetical examples based on our extensive experience from previous years:

Example 1: Full Appraisal for a Newly Finished Home

- Scenario: Initially, a home was appraised before its construction was fully completed. The preliminary appraisal incorrectly included additional square footage, counting space that was ultimately designated as attic space, rather than living area.

- Action: Opted for a full appraisal after the home was completely finished to accurately assess the Gross Living Area (GLA) and include the final layout and specifications.

- Outcome: The full appraisal provided a precise measurement of the living space, correcting the earlier error in square footage. This accurate representation of the property’s finished state led to a proper valuation, ensuring fair property tax and real estate assessments.

Example 2: Desktop Appraisal for a Conventional Home

- Scenario: A homeowner needed to appeal a modest increase in property taxes on a well- documented, conventional single-family home.

- Action: Chose a desktop appraisal due to its cost-effectiveness and sufficient detail for the property type.

- Outcome: The desktop appraisal provided enough evidence to contest the tax increase, resulting in a favorable adjustment without the need for a more expensive full appraisal.

What’s Right For You?

Choosing the right type of appraisal for your property tax appeal is crucial in ensuring the best possible outcome. When discussing desktop appraisal vs. full appraisal, each has its place depending on the complexity of your property and the specific requirements of your appeal. At Triangle Appraisal Group (TAG), we are committed to providing expert guidance to help you navigate this decision-making process.

Remember, a well-chosen appraisal not only supports your appeal but also positions you to manage costs effectively and meet any regulatory requirements confidently. We encourage you to consult with our professional appraisers who can tailor their advice to your unique situation, ensuring that you make an informed decision that best suits your needs.

For further assistance or to discuss your specific property tax appeal, do not hesitate to contact us using our contact form. Our team is ready to provide you with the expertise and support needed to navigate your tax appeal successfully.

Read More

FAQs

Desktop appraisals can be accurate when the property in question is straightforward and well-documented through reliable sources. However, because they do not involve a physical inspection, their accuracy depends on the quality and recency of the data available. They are best used when the property matches well with typical homes in the area.

The most accurate appraisal method is generally considered to be a full appraisal. This method involves a thorough on-site inspection by a qualified appraiser, who assesses the property’s condition, features, and local market trends, leading to a detailed and precise evaluation of the property’s value.

- Full Appraisal – Involves an on-site inspection and detailed report, providing a comprehensive analysis of the property.

- Desktop Appraisal – Conducted without visiting the property, using online data and reports to estimate value.

- Drive-By Appraisal – Involves external inspection from the street and is less detailed than a full appraisal but includes some visual confirmation of the property.

Desktop valuation can be a good option for certain situations, such as when dealing with properties that do not require detailed examination or when time and cost are major considerations. It offers a quicker, more economical way to get a property valuation, though it may not be as detailed or as accurate as a full appraisal

The most comprehensive type of appraisal is the full appraisal. It includes a detailed on-site inspection and a thorough review of the property and its comparables, providing an in-depth analysis of the property’s value.

The most common appraisal type depends on the context but generally, the full appraisal is quite prevalent, especially for mortgage lending, property sales, and tax appeals where accuracy and detail are critical.

After a desktop valuation, the appraiser prepares a report based on the data reviewed, which includes estimates of the property’s value. This report can be used for various purposes, including loan assessments, investment analysis, and property tax appeals. If the desktop valuation is part of a broader assessment process, it may lead to further actions, such as a request for a full appraisal if the initial findings are contested or deemed insufficient.