The Foolproof Home Appraisal Checklist For Your NC Property

December 2024

Getting a home appraisal can feel overwhelming, but with the right preparation, you can maximize your property’s value.

At Triangle Appraisal Group (TAG), we provide expert insights tailored to North Carolina’s real estate market, from the Triangle to Charlotte and beyond.

This home appraisal checklist offers practical, step-by-step tips to help you present your home at its best and ensure a successful appraisal.

What Is a Home Appraisal?

A home appraisal is a professional evaluation of a property’s fair market value conducted by a certified appraiser.

This process ensures lenders, buyers, and sellers have an accurate understanding of the property’s worth.

At TAG, we specialize in appraisals across North Carolina, combining local expertise with industry-leading turnaround times.

Whether you’re refinancing, selling, or settling an estate, our residential appraisal checklist ensures accuracy and transparency every step of the way.

Why a House Appraisal Checklist Matters for North Carolina Homeowners

A house appraisal checklist ensures your property is presented in the best condition, maximizing its value.

Whether you’re selling in the competitive Triangle market or refinancing in Fayetteville, preparation is key to a smooth process.

TAG’s deep understanding of North Carolina neighborhoods, from historic districts to modern subdivisions, guarantees accurate valuations that reflect local trends.

Home Appraisal Inspection Checklist: Step-by-Step Guide

1. Exterior Preparation

First impressions matter. Start by improving your home’s curb appeal:

- Mow the lawn, trim bushes, and remove weeds to create a tidy appearance.

- Repair visible damages like cracks in the siding, loose roof shingles, or clogged gutters.

- Add simple touches like fresh mulch or a clean driveway to enhance the overall look.

- For homes in subdivisions with HOAs, meeting community standards is especially important in North Carolina.

2. Interior Preparation

The inside of your home should feel clean, functional, and move-in ready:

- Declutter and Clean: Tidy each room, removing unnecessary items to make spaces look larger and well- maintained.

- Repair and Refresh: Fix minor issues like leaky faucets, squeaky doors, or chipped paint. Small upgrades, like replacing old fixtures, can also make a difference.

- Showcase Upgrades: Highlight any recent renovations or upgrades, from new appliances to modernized flooring.

3. Documentation

Be ready to show your home’s value with organized documentation:

- Prepare a list of recent improvements, including costs and completion dates.

- Gather important paperwork, such as property surveys, recent tax assessments, and HOA guidelines (if applicable in your area).

4. Maintenance and Safety

Make sure everything in your home is functional and accessible:

- Test HVAC, plumbing, and electrical systems—these are essential in North Carolina’s varied climate.

- Replace lightbulbs and ensure all smoke detectors are working.

- Clear paths to attics, basements, and crawl spaces so the appraiser can inspect them easily.

5. Comparable Sales Knowledge

Understanding local market trends can give you an edge:

- Research recent sales of similar homes in your neighborhood to see how they compare.

- TAG appraisers use tools like Canopy MLS and Fayetteville MLS to access accurate, up-to-date market data, ensuring your appraisal reflects the latest trends.

Tips for a Successful Appraisal in NC

To ensure your appraisal inspection goes smoothly, follow these helpful tips:

- Be Available for Questions: If your property is in a unique or rural area like Cumberland or Chatham County, provide the appraiser with context or details about your home and land.

- Highlight Neighborhood Benefits: Share information about local perks, such as proximity to new schools, parks, or popular amenities like Raleigh’s Mordecai District or Fayetteville’s Cross Creek Mall.

- Prepare for Accessibility: Ensure the appraiser can easily access all areas of the home, including attics, basements, and crawl spaces.

These steps can help the appraiser fully assess your property’s value and align it with North Carolina’s real estate market.

What Appraisers Look for in NC’s Real Estate Market

When appraising a home in North Carolina, certified appraisers focus on these key areas:

- Condition of the Home: Structural integrity, cleanliness, and overall maintenance are crucial, especially for historic properties like those in Raleigh’s Mordecai District.

- Size and Layout: Square footage, number of bedrooms, and the functionality of the floor plan directly impact the appraisal value.

- Upgrades and Features: Modern updates like energy- efficient appliances or smart home technology can boost value, but not always. Unique amenities, such as screened porches or outdoor living spaces, are highly valued in NC’s climate.

- Comparable Properties: Appraisers consider recent sales of similar homes in your area, using data from local MLS databases like Triad MLS or Longleaf Pine MLS to ensure accuracy.

Understanding these factors can help homeowners better prepare and present their property for a successful appraisal.

Additional Tips For Your Refinance Appraisal Checklist

Refinancing appraisals have unique considerations, especially in competitive North Carolina markets like

Charlotte or the Triangle:

- Emphasize Home Maintenance: Lenders often prioritize a property’s condition to minimize their risk. Ensure systems like HVAC and plumbing are in good working order, as they are essential in NC’s climate.

- Highlight Value-Adding Upgrades: Showcase improvements that align with mortgage lender requirements, such as energy-efficient windows, modernized kitchens, or roof repairs.

- Prepare Documentation: Provide detailed records of renovations and maintenance to demonstrate your home’s value growth since your initial loan.

Avoiding Common Appraisal Pitfalls

To ensure your home appraises for its full value, avoid these common mistakes:

- Neglecting Repairs: Overlooking visible issues like peeling paint, broken fixtures, or damaged siding can lower your home’s perceived value.

- Missing Documentation: Failing to provide records of renovations or upgrades such as a new roof, HVAC or electrical systems, can lead to an undervaluation. This can be especially true in areas with unique housing stock like Raleigh’s Five Points or Fayetteville’s historic Haymount district.

- Overlooking Curb Appeal: A poorly maintained exterior can create a negative first impression, which is especially important in competitive markets like the Charlotte suburbs.

- Ignoring Local Trends: Markets in North Carolina can vary widely. TAG’s expertise ensures your home’s appraisal reflects the latest local data, helping you navigate potential discrepancies.

By avoiding these pitfalls, you can help ensure a smooth appraisal process and maximize your property’s value.

The Importance of Being Prepared

A well-prepared home appraisal can make all the difference in achieving your real estate goals.

By following this checklist, you’ll ensure your property is presented in its best light, helping you maximize its value whether you’re selling, refinancing, or planning for the future.

At Triangle Appraisal Group, we bring local expertise and a commitment to accuracy to every appraisal across North Carolina. From the Triangle to Fayetteville, Charlotte, and beyond, our team is here to guide you every step of the way.

Contact TAG today to schedule your appraisal or request a consultation—we’re here to make the process seamless and stress- free.

FAQs

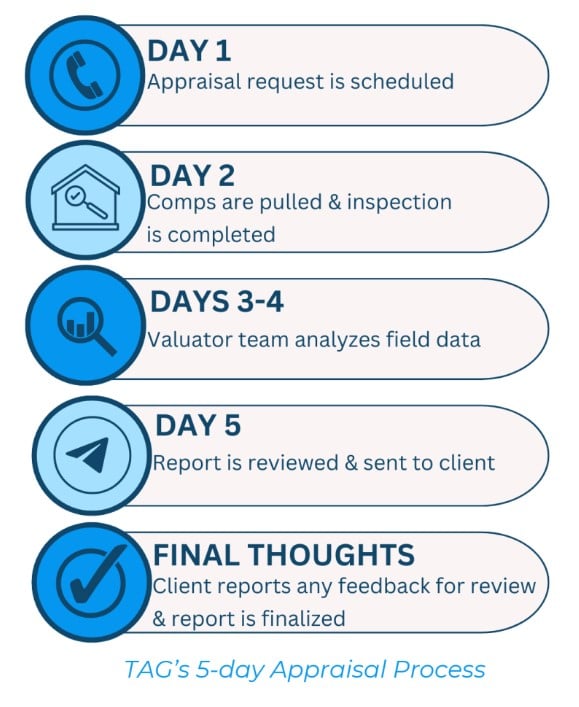

The appraisal inspection typically takes 1-2 hours, depending on the property size and complexity. Our full reports are usually delivered within 3-5 days, though TAG offers faster turnaround times compared to industry norms.

If the appraisal value is lower than expected, buyers and sellers may need to renegotiate the price. For refinances, the loan amount might be adjusted to reflect the appraised value. TAG can provide guidance to navigate these situations effectively.

Yes, if you believe your appraisal is inaccurate, you can provide additional documentation or request a reconsideration of value. TAG’s detailed appraisals are designed to minimize discrepancies and ensure accuracy.

Appraisers evaluate the home’s condition, size, layout, upgrades, location, and comparable sales to determine its fair market value.

Cleanliness doesn’t directly impact value but creates a positive impression and ensures all areas are accessible for inspection.

Key factors include recent renovations, curb appeal, functional updates (like kitchen upgrades, renovated bathrooms, and new flooring), added square footage, and neighborhood trends.