Tips for First Time Home Buyers in NC

Venturing into homeownership in North Carolina? Congratulations on taking this significant step! At Triangle Appraisal Group (TAG), we take pride in guiding numerous individuals like you through this exciting journey.

Have you been searching for reliable tips for first time home buyers in NC? You’ve found the right place. In this article, we will delve into these tips and more, providing real-world experiences that equip you with the necessary knowledge for your upcoming adventure. Are you ready for some expert advice? Let’s get started!

Qualifications for First-Time Home Buyers in NC

As you step into the North Carolina housing market

for the first time, you might be wondering if you

qualify as a first-time home buyer. Here in North

Carolina, you’re generally considered a first-time

buyer if you haven’t owned a home in the last three

years. Yes, even if you’ve owned a home before, but

it’s been more than three years since you sold or

moved out, you qualify again as a first-timer.

Moreover, if you’ve only owned a property that did

not meet state, local, or model building codes and

couldn’t be fixed up without spending more than

building a new one, you might still qualify. Whether

you’re entirely new to this or re-entering the housing

market after a break, North Carolina welcomes you.

From Start to Finish: Your 9-Step NC Home Buying Journey

Now that we’ve covered who qualifies as a first-time homebuyer, let’s dive into the exciting part- your step-by-

step guide to buying a home in North Carolina!

- Assemble Your Real Estate Team: Building your dream team is crucial! This includes an experienced realtor, a knowledgeable mortgage lender, a reliable real estate attorney, and a savvy mortgage broker. They’ll help you navigate the complexities of buying a home.

- Explore Loan Options: North Carolina offers a variety of loan options. We’ll briefly touch on this here, but stay tuned — we’ll go into more detail later in this guide!

- Look for Programs and Grants: We’ve seen many first-time buyers benefit from various programs and grants available in NC. It’s definitely worth exploring every available opportunity! We will go more in depth on

mortgage assistance programs below. - Get Pre-Qualified: Understanding how much house you can afford starts with pre-qualification. This involves a lender evaluating your financial health to estimate how much they might lend you. While the process can seem daunting due to the documents required, don’t worry! We’ve prepared a handy checklist to help you:

- Proof of Identity

- Information on Personal Assets

- Proof of Legal Residency

- Proof of Employment

- Proof of Rent Payments

- Credit History

- Debt Information

- Proof of Income

- Down Payment Amount

Remember, this checklist should cover most needs, but individual lenders may have additional requirements. It’s always best to double-check with them.

- Begin Your House Hunt: Now’s the time to explore and find a place that feels like home, from cozy interiors to beautiful gardens.

- Make an Offer: Found your dream home? It’s time to make an offer. With your excellent team by your side, you’re well-prepared for this crucial step.

- Apply for a Mortgage: Once your offer is accepted, reconnect with your lender to start the mortgage application process. They will guide you through everything, including your home appraisal.

- Close on Your Home: The final step! Sign the papers, exchange keys, and congratulations — you are now a homeowner!

- Celebrate and Settle In: Time to celebrate your new home! Move in and start making those lasting memories.

Exploring Your Loan Options as a First-Time Home Buyer in NC

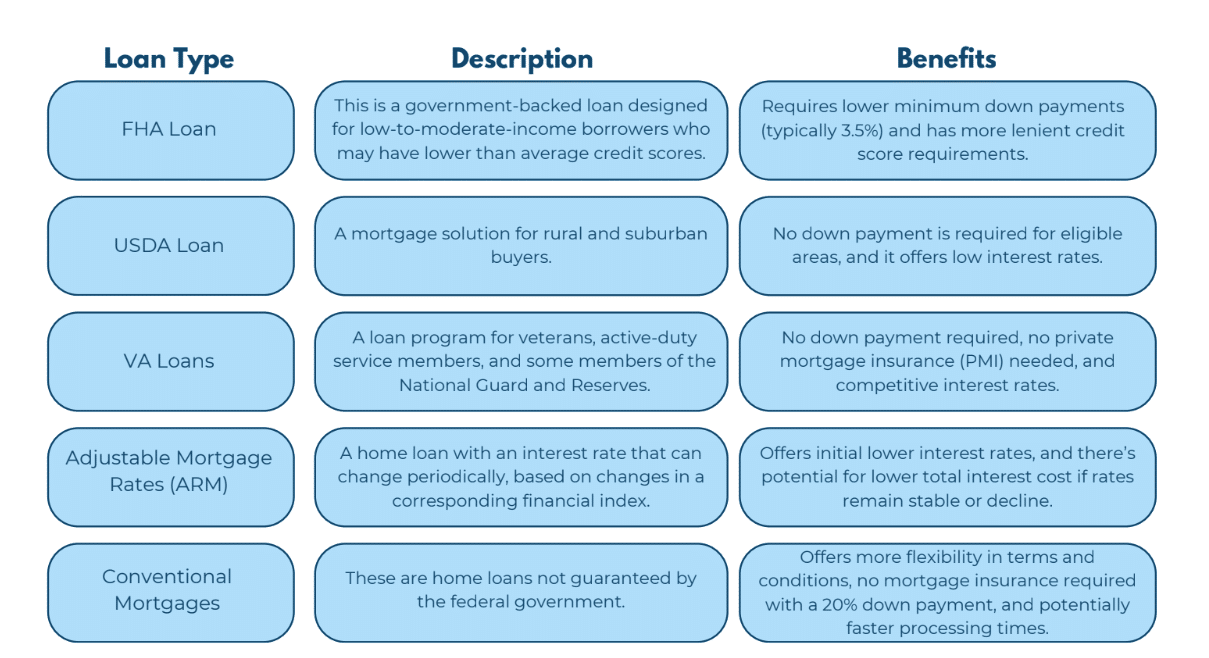

To help you navigate your loan choices as a first-time home buyer in North Carolina, we’ve compiled an

informative chart. Each type of loan has its own unique features and benefits. Use this guide as a quick reference to understand the basics and help decide which loan might be the best fit for your home buying journey:

This chart should help you start thinking about which loan might suit your needs as you step into homeownership in North Carolina. For more detailed information on loan options first-time homebuyers, you can visit NerdWallet’s comprehensive guide.

Mortgage Assistance for NC First-Time Home Buyers

The world of mortgages might seem overwhelming- but don’t worry, you’re not alone! We’ve helped many clients benefit from state programs designed to make homeownership more accessible. Let’s explore three key programs that could help boost your home-buying plans:

- NC Home Advantage Mortgage: This excellent program offers stable, fixed-rate mortgages through participating lenders across the state, tailored for those buying their primary residence in North Carolina. Eligibility is often based on income limits, which vary depending on your county and household size. To apply, just connect with a participating lender who knows the program well. If you prefer predictable monthly payments, this might be the perfect option for you.

- NC 1st Home Advantage Down Payment: One of the biggest challenges for first-time buyers is saving for a down payment. The NC 1st Home Advantage Down Payment program addresses this by offering up to $8,000 in down payment assistance to first-time buyers and military veterans. This program usually pairs with the NC Home Advantage Mortgage and has specific income and purchase price limits. Start by discussing your situation with a participating lender who can guide you through the process. This could be a significant help if the initial down payment is your main obstacle.

- NC Home Advantage Tax Credit For those interested in tax savings, the NC Home Advantage Tax Credit is worth considering. This program can save eligible first-time buyers and military veterans up to $2,000 annually on federal taxes. You’ll need to obtain a Mortgage Credit Certificate (MCC) from a participating lender before closing on your home. If long-term savings and tax season relief sound appealing, this program could be a great fit.

Choosing the right program depends on your specific circumstances and goals. Our best advice? Speak with a financial advisor or mortgage specialist to make the most of what North Carolina has to offer. For more detailed information on these programs, visit North Carolina Housing Finance Agency.

Things to Avoid When Buying Your First Home

Buying your first home is an exciting, nerve-wracking, and ultimately rewarding journey. We have guided many first-time homebuyers and noticed a few common pitfalls that you’ll want to avoid:

- Overlooking Additional Costs: Remember to factor in closing costs, maintenance, utilities, and potential homeowner association fees beyond the listing price.

- Skipping the Home Inspection: A crucial step to understand exactly what you're investing in, helping you avoid unexpected expenses later.

- Making Large Purchases Before Closing: Avoid buying big-ticket items like cars or appliances before closing, as these can impact your mortgage approval.

- Neglecting to Get Pre-Qualified: Understanding what you can afford ahead of time prevents setting your heart on a home that's out of reach.

- Misunderstanding Your Mortgage: Fully grasp the terms of your mortgage; be wary of adjustable rates that might increase over time.

- Letting Emotions Lead: Balance emotional decisions with practical financial considerations.

- Ignoring Resale Value: Even if it feels like your forever home now, consider future resale potential which could change due to various circumstances.

With these tips, you can confidently move through the home-buying process, steering clear of typical pitfalls. Remember, the TAG team is available to provide support and guidance as you embark on your journey to homeownership.

10 Tips for First-Time Buyers in NC

As we conclude our journey through the exciting world of first-time home buying in North Carolina, we are excited to share a collection of essential tips. Drawing from our years of experience standing alongside many first-time homebuyers, we’ve observed the highs and lows, triumphs, and lessons that each unique story brings. From this wealth of knowledge, we’ve crafted our top 10 tips—practical advice we often find ourselves repeating to clients to transform a potentially stressful purchase into a celebration. Here are TAG’s golden guidelines for first-time buyers in NC:

- Budget Beyond the Purchase Price: Remember to account for additional costs like property taxes, insurance, and potential homeowners’ association fees.

- Location, Location, Location: Choose a location that’s not only great for now but also offers potential for future resale value.

- Stay Calm and Be Patient: The home-buying process can feel like a roller coaster. Take deep breaths, stay calm, and embrace the journey.

- Keep Future Plans in Mind: If you’re considering starting a family, think about school districts. Planning to get a big dog? A yard might be necessary.

- Trust Your Gut: While data and advice are crucial, don’t overlook your instincts about a house or neighborhood.

- Always Negotiate: Whether it’s the price, repairs, or closing costs, remember that almost everything is negotiable.

- Research Your Lender: A competitive interest rate is important, but also consider the lender’s reputation and the quality of their customer service.

- Visit at Different Times: A neighborhood might change throughout the day—what’s quiet in the morning could be busy in the evening. Visit at various times to get a true sense of the area.

- Connect with Neighbors: They can offer insights about the community, ongoing issues, or the area’s history that you might not find elsewhere.

- Celebrate the Small Wins: Every step forward, like getting pre-approved or having an offer accepted, is a milestone. Enjoy each achievement along the way!

Happy House Hunting!

These insights from the heart of Triangle Appraisal Group (TAG) are here to guide you through this special time filled with anticipation and excitement. With these tips in your back pocket, you’re well-equipped to find the perfect home for your next chapter. Happy house hunting!

Have you considered a

Pre-Purchase Appraisal?

At the end of your exploration into home buying, have you considered the benefits of a pre-purchase appraisal? A pre-purchase appraisal is an independent evaluation of a property’s value before you finalize the purchase.

This step not only ensures you’re paying a fair price but can also be crucial in negotiating with sellers and securing financing. It provides a detailed analysis of the home’s condition, market value, and potential future worth.

If understanding the true value of your potential new home before committing sounds beneficial, then yes, a pre-purchase appraisal might just be the perfect fit for your home-buying journey. Contact us today to learn more!

Related Resources:

FAQs

First-time home buyers in North Carolina can enjoy several benefits, including access to various state-specific programs like the NC Home Advantage Mortgage, which offers competitive rates and assistance with down payments. These programs can significantly lower entry barriers, making homeownership more accessible and affordable

The down payment for first-time home buyers in North Carolina can vary greatly depending on the type of loan. For example, FHA loans require as little as 3.5% down, while USDA and VA loans might not require any down payment at all. Conventional loans typically require between 3% to 5% down for first-time buyers.

Closing costs in North Carolina typically range from about 2% to 5% of the home’s purchase price. These costs cover various fees such as the appraisal, loan origination, and legal fees. The exact amount can vary based on the loan type, the property’s location, and the complexity of the transaction.

The income limit for a USDA loan in North Carolina varies by county and the size of the household. Generally, the income limit is set at 115% of the median income of the area. This ensures that the benefits are directed towards those who need them most, typically aiding lower to moderate-income households in rural areas