What Is an Appraisal? Uncovering Its Role in Real Estate and Beyond

This question might seem straightforward, but the answer is quite foundational in many financial and legal contexts. An appraisal is a professional assessment aimed at determining the value of an item or property. At Triangle Appraisal Group (TAG), we understand the critical role appraisals play in transactions involving real estate, personal property, and collectibles. Our goal is to ensure that whether you are buying, selling, or just evaluating your assets, you have a clear and accurate understanding of their value.

Our goal is to equip you with the necessary knowledge to navigate these assessments confidently.

What is the Purpose of an Appraisal?

The purpose of an appraisal typically is to establish a fair and accurate estimate of the value of an item or property. This is crucial for a variety of scenarios:

Transactional Support: When buying or selling a home, an appraisal ensures that all parties agree on a fair price based on an objective evaluation. This evaluation considers various factors such as the property’s location, size, condition, and recent sales of comparable properties. Accurate appraisals help prevent disputes over price and facilitate smoother negotiations, providing confidence to both buyers and sellers that the transaction reflects true market value.

Financing: Mortgage lenders require home appraisals to ensure the property they are financing covers the loan amount. This protects the lender by ensuring they do not lend more than the property is worth, reducing the risk of financial loss in case of borrower default. The appraisal process involves a detailed examination of the property and an analysis of market data, which helps lenders determine the property’s fair market value. By doing so, lenders can make informed decisions on loan approvals and amounts, thereby safeguarding their investments.

Legal Matters: In cases like divorce settlements or estate settlements, appraisal reports provide a reliable and impartial value that aids in the fair distribution of assets. During a divorce, a professional appraisal ensures that property division is equitable, preventing conflicts between parties. In estate settlements, accurate appraisals are essential for determining the value of inherited properties, which can impact estate taxes and the distribution among heirs. These appraisals are crucial for legal clarity and fairness, ensuring that all parties receive their rightful share based on current market values.

Taxation: Accurate home appraisals are vital for ensuring that property taxes are fair and reflective of the market. Local governments rely on appraisals to assess property values, which in turn determine the amount of property tax owed by homeowners. Regular appraisals help maintain fairness in the tax system by ensuring that tax assessments are based on up-to-date market conditions. This prevents homeowners from being overcharged or undercharged on their property taxes, promoting a balanced and equitable taxation system.

Insurance: Home appraisals are often required for insurance purposes to establish the replacement cost or actual cash value of a property. This ensures that in the event of damage or loss, the insurance payout reflects the property’s current market value, allowing for appropriate coverage amounts.

Investment Analysis: Real estate investors use appraisals to assess the potential return on investment for properties they are considering buying. This helps them make informed decisions about which properties will provide the best financial returns based on accurate market valuations.

Renovation Planning: Homeowners planning significant renovations may get an appraisal to understand the current value of their home and estimate the potential increase in value post-renovation. This helps in budgeting and making strategic improvements that will maximize the home’s market value.

Market Analysis: Real estate professionals and analysts use appraisals to study market trends and property values in specific areas. This information helps in making strategic decisions about property developments, pricing strategies, and investment opportunities.

By understanding the purpose, you’re better equipped to appreciate its impact on these various aspects of property and asset management. Whether it’s ensuring you’re not paying too much on your next home or securing a loan amount with confidence, the role of an appraisal is integral to many facets of personal and financial decision-making.

Types of Appraisals

Contrary to what you might believe, they are not just for real estate; they cover a broad range of items, each requiring a unique focus. Here’s a look at some common types:

Collectibles and Antiques: Whether it’s fine art, coins, or antique furniture, these appraisals assess the value of items often based on rarity, condition, and historical significance.

Insurance: Used to determine the amount of coverage needed for various items, ensuring that in the event of damage or loss, the insurance payout reflects the item’s current market value.

Commercial Real Estate: Focused on business properties, considering factors like revenue potential in addition to physical attributes.

While appraisals can be used for many different purposes, the TAG team specializes in the valuation of residential homes (1-4 family). Today, we’ll focus on deep diving into the appraisal of real estate to provide a clearer picture of how these critical assessments influence the housing market.

The Home Appraisal Process Explained

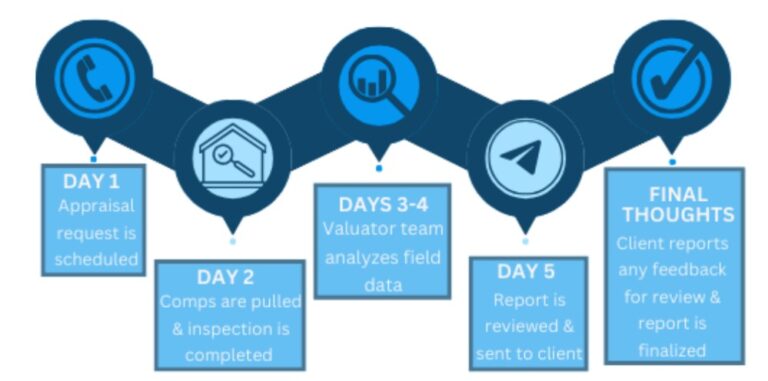

We understand every step of the process is key to ensuring that our clients are fully informed and confident in the valuation of their property. Here’s how we typically conduct an appraisal over a 5-day period:

This process exemplifies how we uphold the appraisal meaning in real estate, ensuring precision and reliability in every evaluation.

Home Appraisal vs. Home Inspection

Understanding the difference between a home appraisal and a home inspection is crucial when navigating real estate transactions. Here’s what each process entails:

Home Appraisal: An appraisal, meaning an evaluation that determines the market value of a property, assesses various factors such as location, size, condition, and comparable sales within the area. This process ensures that lenders, buyers, and sellers can make informed decisions based on a fair sales price.

Home Inspection: In contrast, home inspections focus on the physical condition of the property. Inspectors examine the home’s systems, structural integrity, and overall maintenance needs. This detailed examination helps identify potential issues that might need future repairs and ensures the buyer fully understands the condition of the home before finalizing the purchase.

While both processes are vital, they serve different purposes: appraisals provide a valuation critical for financial decisions, while inspections assess the property’s condition. Understanding these differences can help you better prepare for what to expect and ensure a smoother real estate transaction.

Why Home Appraisals Matter

Appraisals are essential across various financial and legal contexts, extending well beyond typical real estate transactions. They ensure that lenders can lend confidently without exceeding the property’s true market value, thereby preventing financial losses from loan defaults. In real estate, appraisals help maintain market fairness by setting benchmarks for property prices, ensuring buyers do not overpay and sellers receive fair compensation. This accuracy is also vital in determining appropriate insurance coverage amounts, calculating property taxes fairly, and resolving disputes in legal scenarios like divorce or estate settlements.

Moreover, appraisals play a pivotal role in less commonly discussed situations such as estate settlements and significant insurance claims. For instance, after a natural disaster, a precise appraisal is necessary to assess property value loss, crucial for processing claims fairly. This helps in ensuring that all stakeholders, including policyholders and insurance companies, are treated equitably based on current property conditions.

Through these varied applications, appraisals ensure transparency, uphold fairness, and support the integrity of financial systems, proving indispensable in both common and exceptional circumstances.

Empowering Your Decisions with Professional Valuations

At Triangle Appraisal Group (TAG), we understand the importance of providing an answer for the question, “what is an appraisal?” and how it can impact your financial and property decisions. Specializing in residential valuations, our mission is to provide thorough and accurate assessments for your home, whether you’re dealing with property purchases, legal challenges, or insurance claims. By understanding the true value and role of a professional home valuation, you can make more informed and confident decisions. Contact us today to ensure your residential needs are met with precision and reliability.

Read More:

FAQs

During an appraisal, a professional appraiser conducts a thorough evaluation of a property to determine its market value. This process includes an inspection of the property’s interior and exterior, an analysis of comparable sales in the area, and a review of market trends. The appraiser considers factors such as the property’s location, size, condition, and amenities. This comprehensive evaluation ensures that the appraisal reflects the property’s true market value, which is critical for transactions like buying, selling, or refinancing.

Once an appraisal is completed, the appraiser compiles their findings into a detailed report. This report includes an assessment of the property’s features, an analysis of comparable properties, and the final appraised value. The report is then provided to the party who ordered the appraisal, such as a lender, buyer, or seller. This document helps all parties involved in the transaction understand the property’s market value and make informed decisions. For mortgage purposes, the lender uses the appraisal to ensure the loan amount does not exceed the property’s value.

Getting an appraisal is generally good as it provides an unbiased, professional assessment of a property’s value. For buyers and lenders, it ensures that the purchase price or loan amount is appropriate. For sellers, it helps set a fair market price. Appraisals can prevent overpaying or underselling and are essential in transactions to protect all parties involved. However, if the appraisal value is lower than expected, it can complicate the transaction, requiring renegotiations or additional funds.

A seller can potentially back out of a transaction if an appraisal comes in lower than the agreed-upon sale price, but this depends on the terms of the contract. Many purchase agreements include an appraisal contingency clause, allowing the buyer to renegotiate or withdraw if the appraisal is low. If the seller is unwilling to lower the price or negotiate, they may opt to find another buyer. However, sellers should be aware that consistently low appraisals may indicate the need to reassess their asking price.