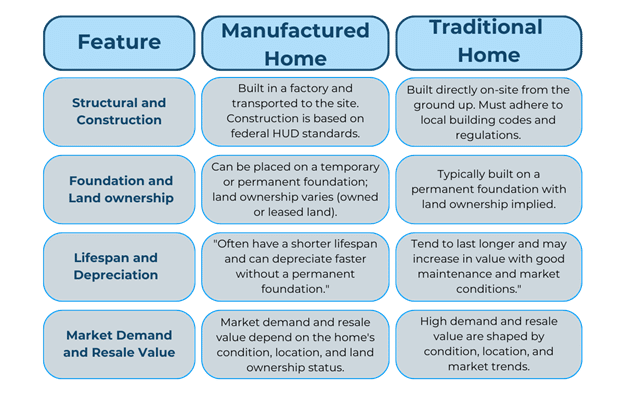

At TAG, we focus on correctly valuing manufactured homes and understand their importance in North Carolina’s housing market. Our expertise not only aids in fair transactions and financing but also reinforces our connection to the community. It’s important to note that while mobile homes can be on owned or leased land, TAG strictly handles mobile/manufactured homes that have a permanent foundation on owned land.

Join us as we share insights and guidance on manufactured homes to ensure you’re informed and valued every step of the way. Welcome to the TAG family, where every home, including manufactured ones, is appreciated.